Brexit Impacts on UK‘s Residual Waste Arisings and Treatment Capacity

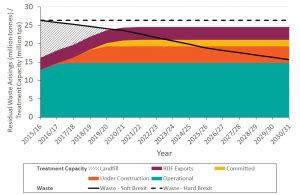

Under a high recycling scenario, which could result from a ‘soft’ Brexit, the UK’s supply of capacity will exceed the available quantity of residual waste in 2020/21 – or in 2023/24 if the export of refuse derived fuel (RDF) is excluded from the analysis.

The worst case scenario for a ‘hard’ Brexit, where there is no reduction from today’s UK residual waste arisings, indicates that 1.7 million tons per annum of residual waste might continue to be available for treatment – or 5.3 million tons, if exports are excluded. These are the key figures of the eleventh issue of Eunomia’s biannual Residual Waste Infrastructure Review that examines the implications of Brexit for residual waste treatment in the UK.

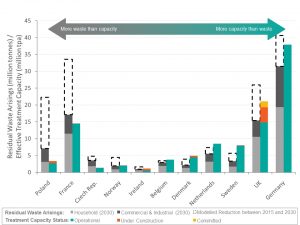

Reductions in residual waste and the development of new facilities have closed the UK’s capacity gap to 10.2 million tons, down from the 12.9 million tons reported in May. Meanwhile, the UK continues to invest in more EfW capacity, with the last six months seeing a number of facilities reaching financial close. There is now 6.3 million tons per annum of treatment capacity under construction or committed, while several new projects are applying for planning consent. However, the UK’s decision to leave the European Union has brought uncertainty in many areas. The long-term nature of investments in residual waste infrastructure makes them particularly reliant on confidence regarding the future shape of the market.

Soft or hard Brexit?

In the event of a soft Brexit, in which the UK maintains access to the Single Market and continues to aim for the same recycling targets as the rest of Europe, the country is on track for the supply of waste treatment capacity to exceed the available quantity of residual waste in 2020/21.

The possibility of a hard Brexit, though, might have quite different implications, depending on the policy direction the UK takes. The report considers a ‘worst case’ scenario for resource management, where the UK’s residual waste arisings stay at current levels, despite expected reductions in Scotland and Wales. This creates a difficult environment in which to plan for the right facilities to meet the UK’s needs, and the uncertainty could lead developers to consider additional investment in UK treatment capacity.

Likely to meet the 2020 target

The recycling rate is a key determinant of the amount of residual waste requiring treatment. The UK is working towards the 50 percent municipal waste recycling target set by the revised Waste Framework Directive. The EU has set out plans for recycling targets of 60 percent by 2025 and 65 percent by 2030 in its Circular Economy (CE) Package. A hard Brexit could in principle see the UK set these targets aside – although this would not necessarily affect Scotland and Wales, which are already aiming for high levels of recycling under their own legislation. However, the UK government might itself recognise the potential advantages of better resource management and itself pursue higher recycling rates, even under a hard Brexit scenario.

With Brexit unlikely to occur before 2019, it is probably that in the meantime the UK will continue its efforts to meet the 2020 target. Whether the UK adopts subsequent targets will depend on the eventual timetables for Brexit and for the CE Package, and the drafting of the Government’s proposed Great Repeal Act, which will see a snapshot of EU law transposed into UK legislation.

RDF exports meet Europe’s appetite

The UK’s need for treatment capacity is also increasingly affected by the amount of residual waste that is exported to the continent as refuse derived fuel (RDF). Initial data for 2016 suggests that RDF exports from the UK will reach 3.5 million tons, up from 3.3 million tons in 2015. Eunomia’s analysis indicates that even a hard Brexit is unlikely to place any legal barrier to RDF exports. The EU rules on waste shipments mimic a wider OECD agreement, of which the UK and the countries to which it exports are signatories. However, if Sterling weakens against the Euro, or if a 6.5 percent EU import tariff proves to apply to RDF, export may become a less financially attractive option – unless continental incinerators opt to reduce their gate fees so as to continue to attract the waste they need.

But Europe’s appetite for RDF from the UK appears likely to increase over coming years, as EU Member States seek to increase their recycling rate, while some continue to increase their treatment capacity. The current capacity gap of 58 million tons will reduce rapidly, and the “Northern Cluster” of countries engaged in the RDF market seems set to reach a situation of potential over-supply of capacity from 2026 onwards.

Fresh look or still 65 percent target?

Eunomia’s Managing Director, Mike Brown, explains: “While we cannot yet say with confidence what form Brexit will take, a hard Brexit could mean taking a fresh look at our need for waste treatment infrastructure. However, there is a risk that during the current period of uncertainty the UK may invest in facilities that could hinder our ability to achieve higher levels of recycling. A soft Brexit is likely to see us still aiming for 65 percent by 2030. That’s still the direction of travel for the rest of Europe, and the result looks set to be a big increase in spare treatment capacity to be filled by RDF exports.”

Eunomia’s report continues to be the only source of estimates through to 2030 and beyond. The long term nature of residual waste treatment facilities means that it is crucial for investors to understand how the waste market can be expected to develop over the coming decades.

The full issue 11 of Eunomia’s Residual Waste Infrastructure Review is available under www.eunomia.co.uk/reports-tools/residual-waste-infrastructure-review-11th-issue.

Photo: jamdesign / fotolia.com

GR 12017