Global Trends of Biomass and Waste-to-Energy Sector

The proportion of renewable energy generated by wind, solar, biomass and waste-to-energy, geo-thermal, marine and small hydro rose from 11 percent in 2016 to 12.1 percent in 2017, says a new comprehensive study by Frankfurt School/UNEP Centre/BNEF on “Global Trends in Renewable Energy Investment 2018”. The upwards trend does not correspond to the development of the bio-mass and waste-to-energy sector.

Globally, overall investment showed great increases of three-digit rate in solar and wind financing, while the biomass and waste-to-energy sector recorded gains at five billion US-Dollar and a loss of 14 percent compared to 2016. The same with asset finance and small distributed capacity investment: In contrast to solar and wind, biomass and waste-to-energy reached three billion US-Dollar and a loss of 52 percent. Concerning public market investment, solar and wind sector registered 2.5 and 2.4 billion US-Dollar respectively, the biomass and waste-to-energy merely 700,000 million US-Dollar.

In the asset finance sector of utility-scale renewable energy, biomass and waste, geothermal, small hydro and marine together just made up three percent in 2017. According to Frankfurt School of Finance & Management gGmbH, biomass and waste-to-energy projects halved the amount of finance from 2016 to 2017. The 36 projects then raised three billion Dollar and thus the lowest figure on rec-ord for the sector since 2004. The decline is probably caused by the United Kingdom’s end of the Renewable Obligation support program, and the Contract-for-Difference auctions that replaced it brought out other main points.

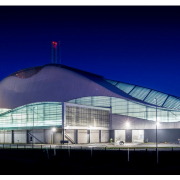

Venture capital and private equity (VC/PE) investment in renewable energy in total fell by exactly a third in 2017 and a sixth of its 2008 peak. As a result, biomass and waste, as well as geothermal and marine, went down to nearly zero. On contrary, as overall Research and Development investment rose across almost all sectors, biomass and waste too gained ten percent to 918 million US-Dollar. And the quota of acquisitions rose by 90 percent to 4.9 billion US-Dollar: through the refinancing of two waste-to-energy plants in Dublin and in Amsterdam raising 525 million US-Dollar and 352 million US-Dollar respectively, and the Marguerite Fund’s acquisition for 111 million US-Dollar in a Portuguese biomass portfolio.

The full report on Global Trends in Renewable Energy Investment 2018 can be downloaded under http://www.iberglobal.com/files/2018/renewable_trends.pdf.

Photo: Reinhard Weikert / abfallbild.de

GR 3/2018