BIR Plastics Committee: Meeting Focuses on “Unavoidable” Technological Advances in Plastics Recycling

“The alarm bells are ringing louder and louder” for plastics recyclers amid worrying economic developments and wider uncertainties, warned BIR Plastics Committee Chairman Henk Alssema of Netherlands-based Vita Plastics in his introductory remarks to the body’s latest meeting in Budapest on October 14, 2019.

But while many companies are currently beset by problems such as high stock levels, Mr Alssema insisted that he is “more positive” about longer-term prospects for the plastics recycling sector. Many major companies are now incorporating larger quantities of recycled plastic into their products, he pointed out. At the same time, progress has continued to be made in plastics recycling technology and particularly in chemical recycling.

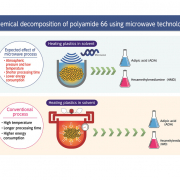

Guest speaker Rob de Ruiter, Senior Business Developer at TNO in the Netherlands, shed more light on some of these latest technological advances. Having insisted that there is still an important role to be played by mechanical recycling, he focused on other options such as solvent-based dissolution and thermochemical conversion. Based on current circumstances, he expected pyrolysis to be “a big factor in the future”.

Mr de Ruiter highlighted the growing involvement of major companies in the recycling sphere, as evidenced by the recent announcement of a Dow/Fuenix partnership covering the supply of pyrolysis oil feedstock made from recycled plastic waste, to be used to make new polymers.

While some of the emerging recycling technologies may take many years to achieve commercialization, Mr de Ruiter assured delegates: “It needs time but it’s unavoidable that we go in this direction.”

Also in Budapest, BIR Plastics Committee board members reviewed latest key developments in their own countries and regions. Sally Houghton of the Plastics Recycling Corporation of California reported that, in the days prior to the meeting, California Governor Gavin Newsom had vetoed a bill which would have mandated minimum post-consumer recycled content in plastic beverage containers. She described the decision as “surprising”.

For the UAE and Saudi Arabia, the report submitted by Mahmoud Al Sharif of Sharif Metals Int’l spoke of “good” scrap prices but slightly slow demand.

Clément Lefebvre of Veolia Propreté France Recycling accepted that market conditions are “not the best” but added that there are “good prices for good quality”. Meanwhile, China has been showing less interest in pellets from Eastern Europe and prices have been heading sharply lower, noted Andrei Mihai Sofian of Rematholding Co. SRL in Romania.

According to the China Scrap Plastics Association’s Executive President Dr Steve Wong of Fukutomi Co. Ltd, current market conditions in South East Asia are “some of the most challenging ever”. Margins have contracted, with many recycling operations either going bankrupt or struggling to survive.

The meeting also heard that BIR is compiling a list of plastics recycling operations – both mechanical processors and otherwise – which it aims to send to the governments of all OECD countries so as to assist them in making informed decisions about what materials can move to those facilities. The world recycling association’s Trade & Environment Director Ross Bartley called on anyone with company listings or other relevant data to supply them to BIR ahead of an October 31 deadline.

Source: Bureau of International Recycling aisbl