Economic Situation in the European Plastics Industry: 6th PIE Readers Survey

The mood across all European plastics industry sectors and regions seems to be rather optimistic, even if the global supply-chain crisis and pandemic-related problems are impeding business performance throughout Europe.

These are the key results of the 6th half-year readers survey on the European plastics industry’s business performance and outlook, conducted by PIE – Plastics Information Europe in July 2021. The questionnaire was open to PIE subscribers and other industry players, and data has been gathered from more than 300 participants from 51 countries.

Having struggled with the pandemic for longer than expected, a heavy percentage of our respondents are expecting to hire more staff in the second half of 2021, despite the fact that a number of them don’t expect coronavirus-related problems to go away anytime soon: one-third of the European industry players say they’re yet to face the worst, with less than half saying they have fully bounced back from the dip caused by the pandemic.

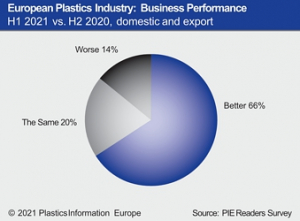

Business performance in H1 2021 for a large number of managers in the European plastics industry equaled or outpaced activity in H2 2020, with a huge majority in the Benelux region declaring that business was so far better this year than the second half of last year. The most optimistic for better business in H2 2021 are the continent’s construction materials and technical parts producers.

As for capital investment plans, a majority of the companies surveyed said their short and medium-term plan for tangible assets remained unchanged during H1 2021, with about one-third reporting an increase in capital spending than originally planned. Interestingly, in our previous survey in January 2021, more than 84% of managers had said capital expenditures in 2021 would either match or exceed outlays in 2020.

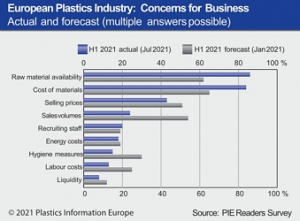

In light of logistical problems, the plastics industry’s top concerns for business performance in H1 2021 were feedstock availability and the cost of materials. Nearly all plastics producers, compounders, distributors and product traders complained about the lack of availability for raw materials in the first half. The situation was better, but far from relaxed, for machine makers and recyclers.

The outlook for H2 2021 is also guided by these ongoing issues. Two-thirds of respondents said they survived the Covid-19 crisis quite well, with nearly half already having returned to pre-pandemic levels. However, 40% predicted their recovery in 2022 at the earliest or said they currently cannot foresee when it will happen, though half of the respondents see the tense supply situation in the global plastics markets easing towards the end of the year. More than half of the survey participants also said that diversification of the supply chain could support the stability of supply.

Source: Kunststoff Information Verlagsgesellschaft mbH (Bad Homburg, Germany, August 02, 2021)