Friendly Acquisitions + Synergies = International Growth

The internationally active Elemental Group, founded in 2010 in Grodzisk Mazowiecki, Poland, has invested 3.315 billion Polish Zloty (over 795 million US-Dollar) abroad and plans to continue expanding globally.

As reported by the holding firm, Elemental Holding SA, which is based in Luxembourg, the Elemental Group (GE) currently comprises 57 companies operating in 35 countries – and it sees itself in line with Polish direct investment abroad. “According to the United Nations Conference on Trade and Development (UNCTAD), Polish direct investment abroad reached a record high of 10,400 million US-Dollar in 2023,” the holding company referred to the information given at that event. “This represents a 64 percent increase compared to the previous year and a 228 percent increase compared to 2021. Moreover, the ratio of Polish direct investment abroad to foreign direct investment in Poland reached 36 percent, the third highest in measurement history. In other words, Poland is transitioning from being merely a cap-ital-absorbing economy to becoming a significant economic force investing in other countries.”

Mergers and acquisitions

The Elemental Group (GE), an international leader in recycling and urban mining, has invested over 288 million US-Dollar (1,200 million Polish Zloty) in major foreign mergers and acquisitions – 17 to date. “Acquisitions must align with the Group’s strategy. The company should be well structured in business terms and maintain a strong financial position. It must also be attractively priced. We pay close attention to the quality of the management team and development prospects,” Paweł Jarski, CEO of Elemental Group, was cited. “The vast majority of our acquisitions are ‘friendly’; we aim to achieve synergies. Typically, we don’t purchase 100 percent of shares initially, as we want the existing owner to continue working with us for some time. We believe that the future performance of our acquired companies largely depends on the quality and satisfaction of the management team, so we always nurture these relationships.”

GE’s first foreign acquisition was Lithuania’s EMP Recycling in 2015, later followed by expansion into Finnish, British, German, and Asian markets. The recycler’s most recent acquisitions in 2024 included acquiring a 51 percent stake in a joint venture with Romco Group, covering Nigeria, Ghana, and the UAE, and an 80 percent stake in Romania’s ACC Recycling Services. The latter plans to build a refrigerator and household appliance recycling plant near Deva, in Hunedoara County. The investment is expected to reach 19.84 million Euro.

Since 2019, Elemental has been operating in the US, generating its highest revenues. According to Slawomir Baran, Head of the Merger & Acquisition Department at GE, the firm has acquired four catalyst-recycling companies in the US. “Considering the volume of catalytic converters collected, we are already the number one player in this market, as well as globally,” he is convinced. Regarding the Group’s acquisition plans, he explained: “We are closely monitoring additional companies in the US, Africa, Asia, and South America. We continuously seek interesting companies that would complement our Group’s strategy.”

E-waste and critically raw materials

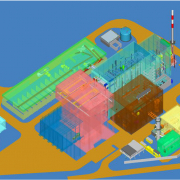

Elemental Strategic Metals (ESM) in Zawiercie, also part of the group, imports raw materials for critical element recovery from approximately 80 locations worldwide (including 33 locations across 16 US states). As underlined by CEO Paweł Jarski, the company focuses on processing material from recycled catalysts, specifically the platinum group metals (platinum, palladium, and rhodium). “Through this investment, the Elemental Group has achieved vertical integration of this business line – we now control the entire value chain from collec-tion through pre-processing, smelting, and refining. At the end of this process, we obtain metals at nearly 100 percent purity. Indeed, the volume of e-waste globally is enormous, and it’s one of the fastest-growing waste categories. Therefore, considering market prospects, we definitely want to develop this business further. Our next strategic step is constructing a copper and printed circuit board (PCB) smelter in Zawiercie, where we aim to achieve vertical integration as well. The investment preparation process and financing arrangements have already begun. Regarding rare earth elements, we are watching this market very closely, but in our opinion, it’s still at a very early stage of development. When we become convinced it’s the right time to enter this market, we will certainly consider acquiring one or more companies in this area.”

In relation to critical raw materials, including rare earth metals and platinum group metals, there is a global expectation of increasing demand. GE aims to enhance its position as a major player in this market. Paweł Jarski is convinced that the group is well diversified geographically, with a collection network in North America, Europe, and Asia. As envisaged in the strategy, the next step would be vertical integration to further process collected materials within the group. “Thanks to the investment in Zawiercie, this vertical integration has already been achieved in Europe for platinum group metals,” he informed. “The next logical step could be investing in a platinum smelter in the US, where we have substantial quantities of our material. This direction may become necessary if restrictions on the free flow of materials between the US, EU, and China continue to increase.”

(Published in GLOBAL RECYCLING Magazine 1/2025, Page 15, Photo: O. Kürth)