Chinese Textile Recycling: The Night Is Darkest Just Before Sunrise

Fashion is the second most polluting industry worldwide. The states contributing to the fiber production mostly export, landfill or incinerate the amounts of used textiles. China does not make an exception but has perhaps found a recycling solution.

In the United States, more than 15 million tons of used textile waste are generated each year, and the amount has doubled over the last 20 years. According to US EPA figures for 2015, a total of 15.75 million tons of textiles in durable and nondurable goods were generated as municipal solid waste, of which 2.45 million tons – 15 percent, respectively – were recycled. 2.99 million tons – 19 percent – went into incineration with energy recovery, while 10.27 million tons – 65 percent, respectively – ended in landfills. Thus, the national textile recycling industry removes approximately 2.5 billion Pounds of post-consumer textiles each year from the waste stream, creating more than 17,000 jobs.

EU: Amount ranges between -92 and +229 percent

In Europe, the textile industry reported a turnover of 171 billion Euro in 2016 as a consequence of increasing demands and increasing volumes of clothing up to 40 percent since 1996. Following figures of Małgorzata Koszewska from the Lodz University of Technology, the collection rates now range between 15 and 20 percent across the EU countries with the rest being landfilled or incinerated. Half of the collected textiles are down-cycled, the other 50 percent is re-used, mostly by exporting to developing countries. The textile waste generation in 2014 differed widely between the European member states: Italy (439,192 tons), Germany (343,757 tons), the United Kingdom (281,235 tons) are at the top and Poland, Belgium, France and Spain above 100,000 tons following; the table ends with twelve countries below 10,000 tons. The changes of textile waste amounts from 2004 to 2014 show an average decline of 48 percent in the 28 countries of the European Union, with reductions in Portugal and Romania of 92 and 90 percent, respectively, but an increase of 55 percent in Germany, 70 percent in Belgium and even 229 percent in Poland.

China: Little recycled or reused

China’s consumers produced some 20 million tons of textile waste in 2013, consisting of 69 percent synthetic fiber products, 28 percent cotton products and three percent other natural fiber products. A large number of used clothes was sent to landfills or the combustion field, while the recycling rate of textile waste was less than one percent, Shi Wang from the Dalian Polytechnic University gave account. According to him, the nation’s recycled textile waste now amounts to three million tons per annum and a multipurpose utilization rate of 15 percent. Figures, published by the China National Textile & Apparel Council, show the landfilling of 20 million tons of textile wastes and an amount of 14.5 kilograms of landfilled textiles per capita in 2013. According to governmental data, nearly 45 percent of industrial and consumer textiles produced in China had been wasted, and only 3.5 million tons of all textile waste collected in 2017 was recycled or reused. Another source published in August 2017 refers to 26 million tons of clothing, a reuse rate of one percent and a re-utilization rate of about 15 percent.

Obstacles for a better recycling

There are at least two accounts of the low re-utilization rate. According to Shi Wang, the Chinese traditionally gave away their old clothes to charitable organizations or poverty-stricken areas. However, meanwhile, the Chinese lost faith in these organizations due to scandals regarding illegal profits and corruption. Companies which are working on a sincerely altruistic and ethical basis and to which the Chinese can give their old clothes to without compunction can rarely bear the enormous amounts of costs for transport, storage and maintenance. The argumentation of Shanghai based stakeholder information magazine Collective Responsibility is that despite 14,000 donation stations and 10,100 charity shops the market for old clothes for charity is strictly regulated and linked with restrictions. Therefore, the amount of old clothes for donation experiences a significant decline. One way out may be opened by exports. Interviews with experts conducted for a study of the Swedish Environmental Research Institute brought to light that China exports used textiles to gradually flooding markets that were previously dominated by European and US used textiles exports. This is most visible in Eastern African markets, where China in 2016 stood for 15 import share percentage in Tanzania, 34 percent in Kenya and 45 percent in Rwanda.

Incineration increasing

Nevertheless, the export of sorted and piled second-hand clothes to Africa and Southeast Asia is at least increasingly restricted, if not prohibited or banned by the import countries leading to higher stocks of unused textiles in China. Besides that, the markets in Africa and Eastern Europe are asking for a better quality of second-hand textiles, leaving more low-grade reusable textiles for recycling which obtain lower prices. On the contrary, the method to send clothes to waste-to-energy facilities finds increasing use in China, as these incineration plants are classified as renewable power generators and allow tax refunds: The 2015 capacity of the W-t-E sector is expected to double by 2020. Singapore, for example, produced 150,700 tons of textile waste in 2016, according to NEA-statistics, of which seven percent was recycled: The remaining amount of 93 percent was incinerated, and the ash disposed of in Singapore’s only landfill.

But if the production of chemical and natural waste fibers will reach the amount of 100 million tons – as the Twelfth Five Year Plan forecasts –, without further standardization and regulation of collection and recycling, the country may perhaps be “bursting at the seams with discarded clothes” and “facing a dire lack of raw materials”, as the article of Shi Wang suggests, or China’s municipalities and local waste industry could undergo an “unprecedented crisis”, as Collective Responsibility presumes. This may be true regarding textile waste of natural fibers like cotton and wool being mechanically recycled or downcycled to material of less value. In contrast, chemical recycling of textile polyester of nylon waste can produce fibers of equal quality compared to virgin materials, as the success story of Zhejiang Jiaren New Materials Co., Ltd. proves.

The growth of Zhejiang Jiaren

The company was established in 2012. On the website, the Zhejiang Jiaren presents itself as “the largest chemical-method cyclic regenerated fiber company in the globe”. The enterprise adopts the trademarked Eco Circle chemical cyclic regenerative system technology owned by Japanese Teijin Company. The process uses wasted polyester materials such as wasted garments and leftover materials as raw materials for production and manufactures them into new polyester fibers with high quality, multi-functions, traceability and eternal cyclicity, through complete chemical decomposition. The initial output consisted of 25,000 tons per year, the second-phase project aimed at 160,000 tons of output annually. A business relationship exists with global companies including Adidas, Nike, Kappahl, H&M, Decathlon, Ikea and Wal-Mart.

In 2016, Zhejiang Jiaren New Materials and Zhejiang Lvyu Environment Protection announced the building of the country’s largest textile recycling base in the Paojiang New District. Furthermore, they decided to increase China’s textile waste recycling capacity within two years to 600,000 tons annually or one-third of all textile waste. The Zhejiang Lvyu Environmental Protection company was designed to turn waste textiles into polyester chips to sell them mainly to domestic textile mills. Some months ago, Zhejiang Jiaren New Materials company – in its own words “the largest chemical recycling base in the world” – launched a new product made from waste textiles titled “Recycled Low-Viscosity Polyester Chips”.

From place nine to place four

Research data presented by UK agency WRAP suggest that once textiles have been collected for re-use and recycling, the best end market is the export market. For example, in 2010, over half of the textiles collected for recycling or re-use in the UK were exported. At that time, the United Kingdom reached a share of eight percent of the total mass exported globally and came third following the USA (18 percent) and Germany (12 percent); China exported three percent and ended up on place 9. In 2016, Market research provider Euromonitor International listed the major exporters of second-hand garments: China – on position number five – reached a share of 7.1 percent in export and was not listed among the leading importing countries. According to the Observatory of Economic Complexity, in 2017 the top exporters of used clothing were the United States, Germany, the United Kingdom and – now place four – China with a 7.1 percent share in export; following the table, nothing was imported. Among the biggest exporters of textile scraps, China made the sixth place in exports with a percentage of 4.7 percent but was then the top importer with 12.4 percent.

The Green Fence 2.0 strategy in 2018 showed consequences for the imports of textiles to China; not less than 11 types of used or scrap textile materials were banned. But – as Shi Wang wrote in 2017 – “coincidentally, many textile companies in China are facing a dire lack of raw materials”. This will not have changed since. According to latest World Trade Organisation data, in 2018 China was not only the top exporter of clothing with a turnover of 158.4 billion Dollar but also by far the leading exporter of textiles with 108.9 billion Dollar and a global share of 37.1 percent. And the 13th Five-Year Plan 2016-2020 maintains stable textile and apparel exports as well as China’s status as a world-leading exporter – in other words: The need for production raw materials will stay constant or even rise if necessary. The demand for cotton as one component of textiles can partly be met by imports from Africa. As a study by the Carnegie-Tsinghua Center for Global Policy clarifies, China – as the world’s largest cotton consumer – refers to international instead of domestic cotton prices and has been steadily increasing its sourcing from Africa. Regarding polyester fiber materials, Zhejiang Jiaren is probably the right contact.

The H&M – HKRITA project

But the question is left open: What happens to used or scrapped textiles in China if the markets cannot absorb them? For finding a solution, the H&M Foundation is funding a four-year 5.8 million Euro partnership with the Hong Kong Research Institute of Textiles and Apparel (HKRITA) to develop recycling techniques since 2016. The mechanical “garment to garment” recycling process shredders the material, recovers the fibers, spins yarn and knits new pieces of textile – the complete production line finds a place in a mobile 40-foot container. The separation of blended postconsumer fabrics contains chemical, biological and physical lines. The chemical separation consists of hydrothermal treatment in a reactor ending in polyester fibers ready for spinning and cellulose powders ready for re-spinning. The biological process includes the modification of the mixed textile waste, fungal cultivation for the production of enzymes, enzymatic hydrolysis and the final product refining. The new biological method results in the recovery of glucose syrup, cellulose powder and re-spun PET yarn. The physical treatment constitutes a dry separation.

In combination, the new recycling techniques show an enhancement of the recycling material properties: cellulose powder in the form of regenerated functional cellulose fiber and superabsorbent polymers (SAP) as well as polyester in solid-state (SSP) or decolorized PET. The chemical and biological separation lines have already reached a pre-industrial scale, while the physical treatment works on lab scale. The Intellectual Property is owned by HKRITA and will be sold.

Has the Holy Grail been found?

At the session of the Textile Division during BIR Convention 2019 in Singapore, Division President Martin Böschen complained that “all the currently technical feasible methods for fiber-to-fiber recycling are not working in a commercially sustainable way, meaning they cannot compete with virgin materials”. Maybe that the HKRITA approach has brought the recycling branch closer to their goals as it was previously expected. Is this the Holy Grail of textile recycling? In March 2019, The Guardian though so and reported that in Australia BlockTexx runs a proprietary technology that separates polyester and cotton materials such as clothes, sheets and towels of any color or condition. The recovered PET is polymerized to create virgin-quality S.O.F.T. branded rPET plastic pellets and polyester fiber suitable for use in textiles, packaging or building products. The recovered cellulose is processed to create S.O.F.T. branded cellulose powder for use in many industries such as textile, pharmaceutical and food.

___________________________

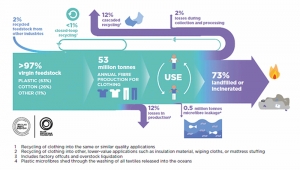

The input to the global materials flows for clothing consists of 97 percent of virgin feedstock comprising 63 percent plastic, 26 percent cotton and 11 percent other material. Two percent of recycled feedstock from other industries and one percent from closed-loop recycling is added. The amount of 53 million tons of annual fiber production for clothing show 12 percent losses and half a million tons of microfiber leakage. After use, 12 percent of the material ends in cascaded recycling, two percent is lost during collection and processing, and 73 percent are landfilled or incinerated, the Ellen Mac Arthur Foundation gave account in 2017.

___________________________

(GR 32019, Page 30, Photo: TexTrade GmbH / Boer Group)