European Plastics Industry: Largely Optimistic Despite Impact of Covid-19

Though initial vaccine rollouts are yet to spark full-blown optimism in the European plastics industry, just around half (47%) of the companies across all sectors and regions expect their business performance in the first half of 2021 to outpace results from the previous six months. Another 42% see a stable business situation in the coming months, compared to H2 2020, with nearly 11% prepared for declines.

These are the main results of the 5th half-year readers survey on the European plastics industry’s business performance and outlook, conducted by PIE – Plastics Information Europe in January 2021. The questionnaire was made open to PIE subscribers and other industry players and saw more than 300 participants from 48 countries.

According to the survey, optimism is the highest in German-speaking Europe and Scandinavia, where more than 58% and 56% of firms, respectively, forecast business improvement. Southeastern European and French respondents, on the other hand, are more pessimistic about the coming months, which is probably a residue of Covid-19 damage. Nearly 26% of companies in Ireland and the UK said that they are projecting declines. The plastics recycling sector, however, seems to be heading for a rebound, with more than 70% respondents predicting an upturn.

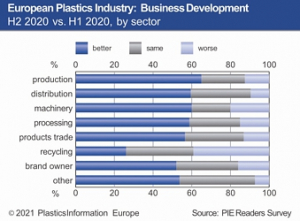

Business development in the 2nd half of 2020 compared to the 1st half of 2020 (Figure: PlasticsInformation Europe)

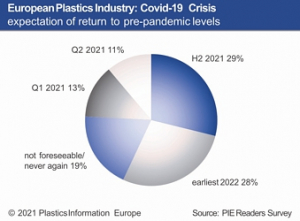

Business confidence for the first half of 2021 declined increasingly, as the focus of managers moved away from their home markets: 45% of respondents said they expected a better domestic result; around 34% forecast an improvement in business with EU 27. Just because some companies have passed the low point of the Covid-19 crisis does not mean they can expect business to bounce back to normal anytime soon. Over half of those polled said they expected a return to normalcy by the end of 2021. For this year, the main concerns for plastics-related business in Europe remain cost of materials, feedstock availability and sales volumes.

Ambitious capital investment plans

Overall, more than 84% of plastics business managers said capital expenditures this year will either match or exceed outlays in 2020, with just under 40% predicting an increase. Over 47% of companies in France and Central and Eastern Europe said they plan to spend more this year than last, and some 44% of firms in Ireland and the UK expressed the same sentiment. Over 28% of managers in Spain and Portugal warned of decreased capital expenditures this year.

The pandemic and its effects remained an issue during the 2nd half of 2020

Looking at the past “coronavirus year”, more than half of all survey respondents (55%) stated that business performance was better in the 2nd half of 2020 than in the 1st half of 2020. About 30% of the companies of the European plastics industry said business activity in H2 2020 was stable, while only 15% noted a worsening situation during the year. While over three-quarters of German firms reported improvements in the period, half of the managers in Norway, the Benelux region, and 35% in France, said business had deteriorated.

Looking at the plastics sectors, more than half of the companies in every business including polymer production, distribution, machinery and plastics converting, other than recycling, cited a

performance superior to H1 2020. For the 2nd half of 2020, 26% of respondents said that the number of employees at their companies rose compared to the first half. More than half of the European companies (54%) said their staff size stayed the same. Despite the coronavirus crisis, these figures are almost the same as they were a year ago, in PIE’s previous survey.

Hygiene measures and social distancing hard to manage in 2020

The top concern for business performance across all respondents – except plastics machinery manufacturers – in 2020 was sales volumes, followed by hygiene measures and social distancing due to coronavirus-related health requirements. Third-most important was raw-material availability – partly as a consequence of global logistical problems. In contrast, energy costs, recruiting staff and liquidity concerns were not as severe as in the past.

Besides direct business-related concerns, several survey participants complained about lockdown and travelling restrictions due to the pandemic, with Brexit also being a big cause for concern within the European plastics industry.

Source: Kunststoff Information Verlagsgesellschaft mbH (Bad Homburg, Germany, February 25, 2021)