Textile Industry: How Project Finance Can Bridge the Commercialization Gap

The Netherlands-based company Fashion for Good, a global platform for sustainable fashion innovation, has teamed up with Spring Lane Capital (USA and Canada) to help unlock the capital needed to scale sustainable innovation in the textile industry.

According to the Dutch company, their report “The Great Unlock – Closing the Innovation Commercialization Gap through Project Finance Solutions” aims to enhance innovators’ understanding of relevant industry stakeholders “and ultimately assists in further enabling the scaling of much-needed innovation”. Furthermore, it would review the different types of capital available to close the funding gap within the commercialization stage. “It discusses the benefits, requirements, and opportunities related to project finance as a funding solution in this space, and highlights the roles that various stakeholders would need to play in order to bring this to life.”

Financial needs for next-generation materials, recycling, and processing

As underlined by the authors – Katrin Ley, Frans Jooste, Jordan Kasarjian, and Nathaniel Lowbeer-Lewis – in line with keeping global warming below 1.5 degrees, the fashion industry is currently in a race to achieve net zero by no later than 2050. “While existing solutions can significantly help reduce the impact of the industry, the scaling of innovations – in particular in next-generation materials, recycling and processing – is critical to enable a transition towards a net zero industry.”

The path to scaling these innovations, however, would be fraught with financial hurdles. “The transition from R&D to commercial viability demands substantial capital, and innovators often face a financing challenge when they arrive at this first commercial production stage.” This would result in a funding gap that prevents industry-wide adoption of new products and technologies. According to the report, the financing required to scale next-generation materials and processing innovations equates to roughly 400 billion US-Dollar, of which approximately 50 percent (or about 200 billion US-Dollar) would be needed in the form of debt financing. “While this number represents all potential debt financing required across the various stages of the scaling journey, the vast majority relates to the commercialization and adoption phases. Unlocking this capital is where project finance plays a key role.”

Project finance

Project finance is a specialized type of financing in which the project’s assets and cash flows serve as collateral for the loans used to finance the project, the authors of the report explained. Project finance would distinguish itself by mitigating risks, bolstering credit ratings, and allowing for greater borrowing capacity based solely on the project’s viability. “It thereby offers a lifeline to innovators who may lack creditworthiness in traditional financing channels.”

In addition, this type of funding is particularly beneficial for new technologies because it allows them to scale effectively and faster compared to traditional funding channels, Fashion for Good and Spring Lane Capital argued. Project finance would also give access to broader debt capital markets and offer longer repayment periods compared to corporate finance, making it more attractive for technology development.

As underlined, the report would provide contractual templates and highlights case studies and lessons learned from innovators during their scaling journey.

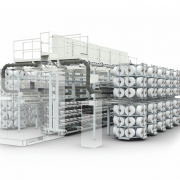

(Published in GLOBAL RECYCLING Magazine 1/2024, Page 5, Photo: SOEX)