Taiwan: Counting firmly on Circular Economy

Taiwan was once known as „Garbage Island“. In several steps, the island managed the transition from an agricultural to a high-tech industrial economy. If it is already a „Recycling

Leader“ too, as media announced, remains to be seen.

Taiwan, evolving from an agricultural economy to a nation focusing on the “development of foundational designs and applications for recycled plastic waste materials”, has three main reasons, says an article published by the Wenzao Ursuline University of Languages at Kaohsiung, Taiwan. First of all, limited natural resources force Taiwan to import 99 percent of its energy resources, 80 percent of necessary minerals and 70 percent of its food. Furthermore, the country is a major player in several global industries, especially in information and communications technology and biotechnologies. Therefore, Taiwan needs permanently available and cheap resources for production. Thirdly, the country is known for its densely populated urban areas with a severe scarcity of land. Thus, the creation of new ground for landfills is problematic.

Strong opposition

In 1993, the waste collection rate on the island reached up to 70 percent. However, without any recycling involved. By the mid-1990s, two-thirds of the island’s landfills reached or nearly reached their limits and caused protests and blockades. As their expansion was no option, the Environment Protection Agency planned to build 36 new incinerators. The proposition came upon strong opposition of the public against incinerators and landfills. Additionally, rapid economic development led to increased volumes of waste. Therefore, the government had to enforce substantial policy changes towards recycling waste and waste reduction and drafted new waste management frameworks to encourage practices that result in generating less waste.

Ranking-position 5

In 2018, the average Taiwanese person produced 850 grams (1.9 pounds) of waste daily, down from 1.20 kilograms (2.6 pounds) 15 years ago. Taiwan’s recycling quota between 2001 and 2016 increased from 12 to 55 percent, showing the third-largest surge over the last fifteen years after Germany and Wales, the European Environmental Bureau gave account. Regarding reported recycling rates of municipal solid waste, in 2019, with 58 percent, the country achieved ranking-position five and with 55.4 percent number two in the longlist for adjusted recycling rates of household waste.

Many hidden numbers

However, the Taipei Times cited Taiwan Watch Institute secretary-general Herlin Hsieh who was skeptical because of “many hidden numbers”. Although officially about three million tons of waste were notified to be incinerated, more than 4.2 million tons were burned. The sum of waste disposed of by informal and private collectors is not added to the total amount of waste. However, the recycling volume is included in the nation’s recycling statistic and falsifies the recycling quota. Waste collectors intermixed electronic waste from other countries to receive subsidies. An estimated 60,000 end-of-live computer monitors were found near a collector’s plant – piled up. All in all, for Herlin Hsieh, the recycling figures show a “gross overestimation”.

A well-operating program

A study in 2020 certifies Taiwan‘s “well-operating waste minimization and resource recycling programs”. Correspondingly the before mentioned Kaohsiung study indicates a landfill disposal rate reduced by 98 percent and several landfills that fell from 187 in 2007 to 83 in 2017. About 25 incinerators with a daily capacity of ca. 24,000 tons are in operation, treating 97.47 percent of the non-recyclable waste. Approximately 65 percent of the processed garbage is household waste, while 35 percent counts as industrial waste. And the country’s economy generates 3,130,735 tons of refuse for disposal and 4,113,808 tons of recyclable waste recycled.

Infrastructure under pressure

But according to a study on “Municipal Solid Waste and Utility Consumption in Taiwan” in 2020, the infrastructure of waste treatment is not only under pressure due to natural disasters like typhoons and earthquakes. It also has to deal with many of the operating incineration plants that are reaching either a major service period – in the worst case, that means struggling with low

capacity – or their end-of-life. Some municipalities want their waste to be treated or disposed of by facilities of other cities and counties. Above all, Herlin Hsieh figured out that incineration plants preferred the treatment of industrial waste. Household waste, in contrast, was not prioritized. The facilities were constructed under the motto “one incineration plant for each municipality” and were designed for processing household waste. However, transferred to local governments and run by private companies, they were allowed to accept industrial waste. By treating household waste, their operators earn more than 1,000 New Taiwan-Dollar (35 US-Dollar), instead of burning industrial waste between 1,500 and over 2,000 New Taiwan-Dollar (53-71 US-Dollar).

A growing recycling market

Anyhow, recycling developed. According to the Environmental Protection Administration, Executive Yuan, the recyclable waste recycled by implementing agencies from 2007 to 2017 totaled 2,408,429 to 4,113,808 tons. In 2015, an online magazine characterized Taiwan as a growing recycling market and expected a recycling boom. The article showed the number of recycling firms increasing from about 100 in the 1980s and 1990s to more than 1,600 at present. In March 2017, the online-newspaper Taiwan Today even published that the national waste management and recycling business, operating everywhere in terms of transport, sorting, cleaning, incineration or reuse, was “a hundred-billion-dollar industry connecting 6,000 firms and involving 230,000 jobs”. Taiwan’s Industrial Development Bureau of the Ministry of Economic Affairs stated that the recycler’s revenue increased from one billion US-Dollar ten years ago to 2.2 billion (US-)Dollars in 2014.

Plastics recycling – the most successful

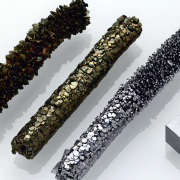

The plastics recycling industry turned out to be the most successful. Already in 2014, the Taiwanese Environmental Protection Administration specified a recycling rate for plastics of 73 percent and reported the collection and treating of 180,000 tons of used plastic to raw materials worth 140 million US-Dollar. More than that: The national Food Hygiene Policy determined not to turn recycled containers into food containers. So, nearly two-thirds of Taiwan’s PET bottle plastic is recovered to textile fibers, requested by local textile companies like the Far East and Shin Kong or foreign producers for shoes and sportswear like ADIDAS. The authors Ching-Yan Wu, Mei-Chih Hu and Fu-Chuan Ni are sure that this “made Taiwan a leading global partner among recycling industries and, in green supply chains for textiles, information technology, and electrical and electronic components”. Taiwan’s PET bottle recycling rate in 2018 reached as high as 95 percent, the Department of Information Services, Executive Yuan, announced.

Change to sustainability

Following the Kaohsiung paper, the Taiwanese government plans to change the industrial base into a sustainable circular economy. Likewise, the goal of most small and medium enterprises is to cut reliance on imports like rare earth or fossil fuels and to increase productivity. Contract chipmaker Taiwan Semiconductor Manufacturing Company, for example, wanted to reach an internal waste recycling rate of 61 percent by 2020 and is said to capture and reuse 95 percent of its waste products. Electronics producer ASUS intends to recycle 20 percent of its global waste by 2025 and recycled a 12.2 percent recovery ratio of total products sold. Packaging paper manufacturer Cheng Loong Corporation uses 94 percent of its raw materials from recycled paper. And steel manufacturer China Steel Corporation provides by-products from its steel production for other producers.

Demanded: International standards

“The number of sustainability reports for Taiwanese companies has risen significantly over the last years”, says the Kaohsiung paper. Nevertheless, it also wants to draw attention to the fact that small and medium enterprises need government-led assistance to realize a transition into a circular economy. That is not only necessary because of increasing domestic regulations and related national policies. It is also essential considering demanded standards set by international customers or investors. In 2018, the Department of Investment Services, Ministry of Economic Affairs named a few: JX Nippon Mining & Metals and Tanaka Precious Metals from Japan invested in the recycling of gold, silver, copper, iron and others. The U.S. firm Nippon Refine and World Resources Company both focus on copper, nickel and zinc recycling. The Singtex Industrial Co. produces fabrics from coffee-ground fibers.

Governmental measure taken

During the last years, several numbers of governmental measures got off the ground. The Waste Disposal Act for example, adopted to provide a framework throughout the institutionalization and industrialization of Taiwan’s waste recycling sector, has gone through 14 legal revisions, the latest in 2017. The Recycling Fund greatly advanced recycling in Taiwan by supporting the purchase of more than 1,300 recycling vehicles for municipalities since 1998: Money from the special income fund has also financed 273 storage facilities for 326 municipal collection squads since 1998, the Environment Protection Agency gave account. The ‘Five Plus Two Industry Innovation Plan‘ was adopted to substitute the innovation-driven economic growth. One of its goals is a circular economy, to be realized by fostering large-scale energy resource recycling centers, promoting international cooperation, and establishing cross-sector cooperation platforms for circular economy cooperation and industry resources linking and matching. Accordingly, in 2018, the government forced plans to establish several test sites for circular economy pilot projects: In fact, the Ministry of Economic Affairs drafted a program that would focus on recycling industrial waste from three companies such as gypsum from Formosa Plastics Group, slag from China Steel Corp and paper from Chung Hwa Pulp Corp. Given 19.61 million tons of industrial waste generated in 2018, 16.01 million tons or 81.6 percent were recycled, while the remaining 18 percent stemmed from these three firms, according to Minister Without Portfolio Chang Ching-sen.

Welcome to invest

In a brochure titled “Taiwan. Key innovative industry – circular economy” (www.roc-taiwan.org/uploads/sites/29/2018/03/Circular-Economy.pdf), the Department of Investment Services, Ministry of Economic Affairs, clarified the governmental roadmap and its potential. “With a complete ecology of industrial chains and clusters, Taiwan is an ideal place for energy and resource integration technologies and waste recycling”, the paper underlined. It confirmed that the policy focus is lying definitely on circular economy, opening “developing business opportunities in the new materials market”. With interesting potentials offered: “International enterprises are welcome to invest in Taiwan for joint ventures, technology transfer, or joint development for advancement into the new materials market in the Asia-Pacific region.” Business Sweden, a business developer with a unique mandate to help Swedish companies grow global sales, was convinced. “Altogether, this new scenario presents promising opportunities for Swedish suppliers of equipment and services in Taiwan. Now is also the opportune moment to engage in new research projects and collaborations”, the agency commented in August 2019.

(Published in GLOBAL RECYCLING Magazine 1/2021, Page 24, Photo: Markus Winkler / pixabay.com)