Recycled Graphite for New Batteries

If the experts are right, the mineral graphite will have a steep “career” in 2022. This mineral is the key element that forms the anode of lithium batteries. “Without it, there will be no energy revolution, and the trillion-dollar EV market might not exist,” third party publisher and news dissemination service provider FN Media Group, LLC, informed in December last year. In 2019, the global graphite market was valued at 14.9 billion US-Dollar. By 2027, it would be expected to be valued at nearly 22 billion US-Dollar. “It might be worth much more than that.”

As reported by author Tom Kool, each EV (electric vehicle) battery contains 20 to 30 percent of graphite, “which means that graphite demand will soar in tandem with EV demand”. While EV giants had been busy scrambling for lithium sources worldwide, there were concerns about a lack of graphite supply. Some 90 percent of graphite anodes used in batteries come from China, the information revealed. For the USA, this mineral would become a national security issue.

USA-based Graphex Group Ltd – a world leader in graphene technologies and products used in electric vehicle (EV) battery and energy storage production – had long-term contracts in China and was working with some of the largest firms. Now, they were “looking to jump into the US and European markets to help supply the growing battery manufacturing industry just beginning to be established, where new supplies of graphite are feeling the squeeze. Graphex’s President John DeMaio is making a push with the expansion of their USA-based team to focus on the North American and European expansion plans to be an integral part of the supply chain being created to support the western EV industrial complex currently being built.”

According to FN Media Group, in 2019, the demand for spherical graphite (also known as battery-grade graphite) in China alone was 200,000 tons and increased to 240,000 tons in 2020. At that time, the need for graphite was expected to reach 1.9 million tons by 2028. Furthermore, in September 2021, the International Energy Agency (IEA) had forecast that the electric mobility and low-carbon energy sectors would demand 25 times more graphite per year by 2040 than today.

Significant more recycling

A way to ensure the graphite supply is recycling from spent lithium-ion batteries (LIBs). According to the publication AZO Materials, the graphite anodes have the same cycle capacity as virgin graphite anodes. “Because of its pure constituent materials and stable carbon structure, wasted graphite has gained a lot of interest as a key building material for anodes.” But the majority of current recycling systems were pyrometallurgical and hydrometallurgical, “which necessitate multiunit operation, high energy consumption, and financial burdens,” the publication referred to the study “Critical strategies for recycling process of graphite from spent lithium-ion batteries: A review”, conducted by Liu, J., Shi, H., Hu, X., Geng, Y., Yang, L., Shao, P., & Luo, X. in 2021. As stated, there was no graphite recovery technology in operation in the industry because of the inability to balance the link between pollution and cost.

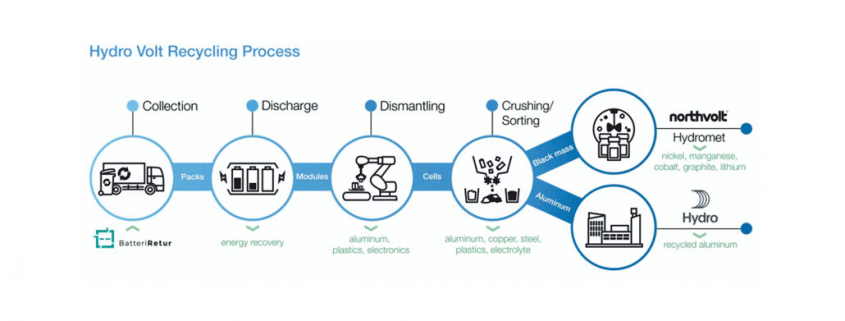

However, new capacities for battery recycling will come on stream. In Europe, for example, the Scandinavian companies Northvolt and Hydro have collaborated to establish a “first-of-its-kind battery recycling facility” in Norway, which – under a joint venture named Hydro Volt – was planned to come online in 2021 in Fredrikstad, outside of Oslo. Hydro Volt is to secure end-of-life EV batteries via Batteriretur, a well-established Norwegian recycling company.

The principal intent for the plant will be for initial collection and handling of batteries followed by processing them up to the point of recovering aluminum, copper, steel, plastics, electronics and electrolyte. Once these materials are set aside for processing by third parties, or in the case of aluminum, by Hydro, the remaining material is a fine, black powder. This compound material, referred to as black mass, contains metals nickel, manganese, cobalt, graphite and lithium and requires special treatment, which will be undertaken by Northvolt in Sweden. Initial black mass volumes will be directed to Northvolt’s pilot recycling plant at Northvolt Labs in Västerås.

At commissioning, the Hydro Volt facility is planned to have the capacity to process more than 8,000 tons of batteries per year – roughly the equivalent of 23,000 moderately sized EV batteries. In a second phase, expansion of the Hydro Volt plant could see capacities ramp up in line with increases in the availability of end-of-life batteries. There are more initiatives. In November last year, Northvolt reported that its recycling program, Revolt, has produced its first lithium-ion battery cell featuring a nickel-manganese-cobalt (NMC) cathode produced with metals recovered through the recycling of battery waste. The company now turns its attention to the scaling-up of recycling capacities to fulfill its aim of producing cells with 50 percent recycled material by 2030.

To secure this, Revolt Ett, the company’s “first giga-scale recycling plant” under development adjacent to Northvolt Ett Gigafactory in Skellefteå (Sweden), would be expanded beyond its initial design to enable recycling of 125,000 tons of batteries per year, the company announced. With construction beginning in the first quarter in 2022 and operations in 2023, the recycling plant would receive incoming material for recycling from two sources: end-of-life batteries from electric vehicles and production scrap from Northvolt Ett.

Europe’s largest battery recycling plant

In addition to becoming Europe’s largest battery recycling plant, Revolt Ett would be the “only large-scale facility in Europe” capable of recycling lithium in addition to nickel, manganese, cobalt and other metals, Northvolt is convinced. “Recovered materials from Revolt Ett will supply neighboring Northvolt Ett cell manufacturing Gigafactory with recycled metals sufficient for 30 GWh of battery production per year (half of Northvolt Ett’s total annual cell output).” In America, Canada-based Li-Cycle Holdings Corp. announced in December last year that it would proceed with the construction of its first commercial Hub facility, which is being developed near Rochester, New York.

Because of the rapidly growing demand for lithium-ion battery recycling, Li-Cycle intends to increase the input processing capacity of the Hub by over 40 percent, from 25,000 tons to 35,000 tons of “black mass” annually (equivalent to approximately 90,000 tons of lithium-ion battery equivalent feed annually). With its increased capacity, the Hub would be able to process battery material that is equivalent to approximately 225,000 electric vehicles (“EVs”) per year, a press release said.

www.northvolt.com

www.hydro.com

www.li-cycle.com

(Published in GLOBAL RECYCLING Magazine 1/2022, Page 16, Photo: Northvolt AB)