Waste-to-Energy Boom Takes a Break – but new Markets are on the Horizon

As per a German-based consultant firm and provider of market intelligence ecoprog, the market for thermal waste treatment plants is set to grow further. The company has published the 16th edition of its annual study on the global Waste-to-Energy (WtE) sector.

As stated by the market research firm, new project awardings in China and the UK are declining. ecoprog expects large parts of the UK’s WtE market to become saturated by around 2026. While these former boom markets are moving towards a soft landing, other countries in Asia, Europe and the Middle East show significant potential for the future.

Today, more than 2,700 thermal treatment plants are in operation worldwide, with a combined capacity of about 530 million tons of waste per year. ecoprog estimates that more than 3,000 plants with a capacity of more than 700 million tons will be in operation by 2032.

Asia

China has seen a steady decline in new project awardings in recent years. That is partly due to the slowing economy, and material recycling of waste is becoming more important in China. As of 2023, the country’s capacity target for 2025 of 292 million tons per year has already been exceeded, but the market is not yet saturated. ecoprog expects the Chinese thermal waste treatment sector to experience a soft landing in the coming years, with new capacities declining steadily to 4.8 million tons in 2032.

Other promising markets in Asia, such as Thailand, Indonesia, and India, are not yet able to absorb the market slump in China. Amongst other reasons, this is due to insufficient financial and regulatory support from governments in most of these countries. Nevertheless, even if many projects in these new WtE markets fail, the number of realized projects still increases, ecoprog informed.

Europe

In the UK, the long-standing boom in new project awardings has slowed down noticeably in 2023. Large parts of the UK’s WtE market will become saturated by around 2026. However, while the European market is still being dominated by the development in the UK, several other European countries show a significant market development as well. These include countries such as Poland and the Czech Republic, but some projects also emerge in traditional WtE markets, like Italy and France. In the established markets, maintenance and retrofits are becoming increasingly important.

Increasing commercial potential

In addition, further new markets will emerge or continue to grow in the future. That includes the Americas, with Brazil in particular. ecoprog also sees a growing market potential in the Middle East, especially in economically stronger countries, such as Saudi Arabia and Kuwait.

As underlined by the company, taxation regarding carbon dioxide is an increasingly important issue for the WtE industry. “CO2 pricing directly increases the cost for waste incineration, and this, if not accompanied by higher landfill taxes, could contradict efforts to stop landfilling. In Europe, it can be expected that the EU will require the WtE sector to pay for the fossil CO2 within the European Emission Trading System. However, introducing CO2 taxes could also create new opportunities for the industry, most prominently through carbon capture and storage (CCS) or utilization (CCU). Thus, in 2023, several new carbon capture projects have emerged at existing or planned facilities in Germany, Denmark, Finland, the UK, and the United Arab Emirates.”

The new market report “Waste-to-Energy 2023/2024” is available at ecoprog.com/publications/data-wte.

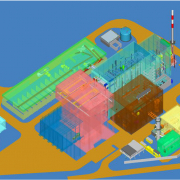

(Published in GLOBAL RECYCLING Magazine 1/2024, Page 26, Photo: Zweckverband Abfallwirtschaft Raum Würzburg / abfallbild.de)