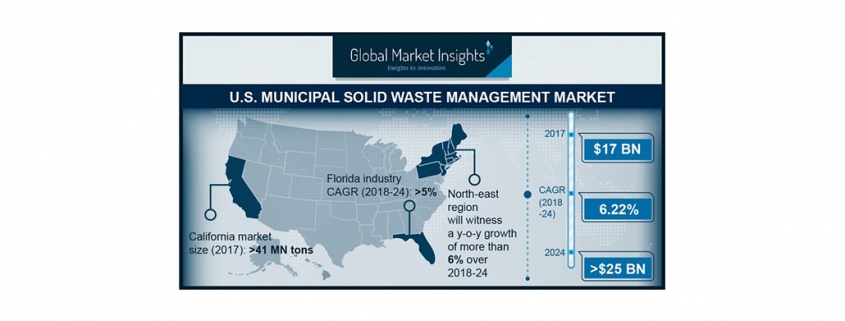

U.S. Municipal Solid Waste Management Market to exceed $25bn by 2024

Increasing population on account of significant surge in the number of foreign immigrants will stimulate the municipal solid waste management market. According to the EPA from 1960-2016, the region population has surged by over 75% from which more than 40 million are foreign immigrants. California municipal solid waste management market was valued over 41 million tons in 2017. Government favorable measures including CalRecycle to promote the various recycling activities will uplift the business landscape over the forecast timeframe.

Landfilling in 2017 hold the prominent share of over 60% of the municipal solid waste management market. Over the coming years the practice is anticipated to witness a sluggish growth with the introduction of stringent anti-dumping laws by both federal and state regulators.

Ongoing adoption of optimized trash treatment techniques along with increasing environmental concerns will accelerate the U.S. MSW management market size. Increasing waste generation owing to large scale urbanization will further stimulate the industry growth. As of 2015, over 80% of the country’s total population was residing in the urban areas which was previously 75% in 1990.

Browse key industry insights spread across 470 pages with 706 market data tables & 28 figures & charts from the report, “U.S. Municipal Solid Waste Management Market Size By Source (Paper & Paperboard, Food, Yard Trimmings, Plastics, Others), By Consumer (Residential, Commercial), By Service (Recovery{Recycling & Composting[Paper & Paperboard, Glass, Metal, Plastic, Others], Incineration & Combustion[Paper & Paperboard, Glass, Wood, Plastic, Others]}Landfill{ Paper & Paperboard, Metal, Plastic, Food, Other} Industry Analysis Report, State Outlook (Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming), Application Potential, Price Trend, Competitive Market Share & Forecast, 2018– 2024” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/us-municipal-solid-waste-management-market

New York recycling and composting MSW management market in anticipated to exceed over USD 450 million by 2024. Government favorable norms to encourage sustainable trash management will complement the business outlook. The department of sanitation has availed comprehensive list for various recyclable materials and their detailed recycling information in their website along with their weekly pickup.

Increasing domestic consumption pattern with rising purchasing power will significantly accelerate the U.S. municipal solid waste management market. As per Bureau of Labor Statistics average annual expenditures per consumer for 2017 was valued over USD 60,060 which is 4.8% increase from 2016 level.

Development of various community based organic recycling approaches to achieve a sustainable economic status will tend to drive the Midwest MSW management market. The University of Minnesota is running U of M recycling drive under which annually more than 3,800 tons of recyclable materials has been processed which is over 40% of total MSW generated in campus.

Key industry participants include Covanta Holding, The CP group, Hi Temp Technology, Stericycle, Green Conversion, E.L. Harvey & Sons, Xcel Energy, Recology, Wheelabrator, Clean Harbors, Sims Metal Management, Waste Connections, Veolia, Suez Environment, The Hoskinson, Hitachi Zosen, SR20 Holdings, and John Wood.

Source: Global Market Insights, Inc.